Copy trading for Investors

Invest in the strategies of professional traders

and earn passive income.

How the service works

- You choose an investment master and connect to their trading strategy.

- The investment master trades with their funds, and the service automatically copies the trades.

- The investment master earns, and you earn too.

GC Invest is the easiest and most reliable way to earn on investments

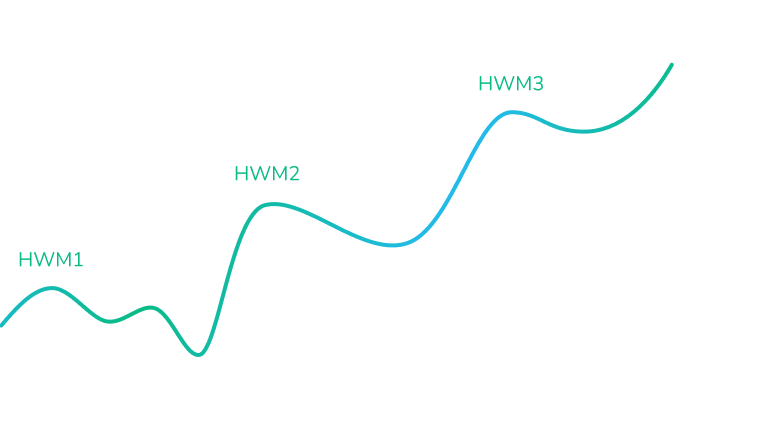

Masters' fee calculated by HWM-system

Masters provide access to copy their trades in exchange for a commission on the investor's profits.

Each investment master sets the commission's size in the range of 0% to 70%.

The master's remuneration is calculated according to the High-Water Mark (HWM) system: the master receives remuneration from the net profit earned for the investor.

Each investment master sets the commission's size in the range of 0% to 70%.

The master's remuneration is calculated according to the High-Water Mark (HWM) system: the master receives remuneration from the net profit earned for the investor.

Best Investment Masters

You get full access to the transparent and comprehensive performance metrics of the investment masters that make your best choices.

Availability

You can connect to the investment master and receive income from investments with a deposit of at least 100 USD.

Transparency

All data on transactions and the movement of funds are always available in your Private Office in real-time.

Risk control

Set and vary your own customizable risk ratio and limit the amount of loss you can afford to take, giving you full control over your potential exposure.

How to become an investor and start earning?

Become an Investor- Register, verify your account, and open an "Invest" account in your Private Office

- Select an investment master from the rating and go to the profile of their trading strategy

- In the master's strategy profile, click "invest" and select the investment amount

- The master's trades are now automatically copied, and the profit is credited to the balance of the investment strategy. Success!

FAQ

In just three steps:

Open an account at Grand Capital and verify it in the Private Office.

Follow to the 'Investments' section, open an Invest Wallet and deposit it.

Click the 'Go to copy trading area'. Click the 'Leaderboard' button in the upper section to see the list of strategies. Here you can invest in the strategy that you like.

Good luck!

Open an account at Grand Capital and verify it in the Private Office.

Follow to the 'Investments' section, open an Invest Wallet and deposit it.

Click the 'Go to copy trading area'. Click the 'Leaderboard' button in the upper section to see the list of strategies. Here you can invest in the strategy that you like.

Good luck!

The minimum investment amount is 100 USD.

You begin to receive the first profit as soon as your investment master begins to close the trades with profit. The higher the profit of the investment master, the higher is your profit.

If you wish to multiply this parameter, set the 'Ratio/lot' in the strategy settings higher. Careful, though: the higher the potential profit, the higher is the risk of potential loss.

If you wish to multiply this parameter, set the 'Ratio/lot' in the strategy settings higher. Careful, though: the higher the potential profit, the higher is the risk of potential loss.

Open the rating of investment masters and set filters. Please choose the most interesting strategies for you from the resulting list and go to their profile. Check out the detailed statistics of each of the strategies and connect to the one that seems to be the most profitable for you.

Please note:

A high-profit strategy in a short period is not always good. Often small but stable profitability can be more promising.

Remember that risk is often directly proportional to potential profit — the riskier the strategy, the more profit it can bring in the short and medium term.

Please note:

A high-profit strategy in a short period is not always good. Often small but stable profitability can be more promising.

Remember that risk is often directly proportional to potential profit — the riskier the strategy, the more profit it can bring in the short and medium term.

Yes, you can - with our service. You diversify your risks this way, while diversification is one of the ways to reduce your trading risks.

If you chose the single strategy, and the investment master had the series of unsuccessful trades in a row, this will impact your trades too.

But, if you invest in a number of strategies, the losses of one or several of them will be covered with the profit from other strategies.

Just mind, that any new investment needs new invest account.

If you chose the single strategy, and the investment master had the series of unsuccessful trades in a row, this will impact your trades too.

But, if you invest in a number of strategies, the losses of one or several of them will be covered with the profit from other strategies.

Just mind, that any new investment needs new invest account.

All investment master's trades, both opened and closed, can be tracked in the copy trading section (tab "Trade Report" in the investment account menu).

No. All money remains with you and is used only to copy the master's transactions.

The master trades only with his/her funds.

The master trades only with his/her funds.

The investment master himself sets the commission for each strategy in the range from 0 to 70%. The commission is charged only from the investor's net profit.

The master can change the commission amount and the calculation period, but the new conditions will apply only to those investors who joined after the changes. Nothing will change for those who subscribed earlier.

The master can change the commission amount and the calculation period, but the new conditions will apply only to those investors who joined after the changes. Nothing will change for those who subscribed earlier.

This is possible in our service! Transactions are copied to your account with an automatically set copy ratio (see the question "Are the risks for masters and investors balanced?"). If the master's balance is larger than yours, the transaction will be copied to your account on a reduced scale, and vice versa (while the transaction size cannot be less than 0.01 lots).

It is necessary to remember the risk coefficient: the volume of the transaction is multiplied by this coefficient after it is adjusted for the copy coefficient. Carefully calculate these indicators before setting them!

It is necessary to remember the risk coefficient: the volume of the transaction is multiplied by this coefficient after it is adjusted for the copy coefficient. Carefully calculate these indicators before setting them!

The levels of potential profit and risk are equalized for investors and masters with the help of the copy ratio. The copy ratio is a coefficient that is automatically set when investing in a strategy. It is the ratio of the investor's account balance to the master's account balance (Copy ratio = Investor's account balance / Master's account balance).

Example: you invest 1000 USD in the strategy, the master's account balance is 10,000 USD. The copy coefficient will be calculated automatically when connected to the strategy and will be 1000/10000 = 0.1. When copying, the volume of transactions of the master will be multiplied by this coefficient. For example, if the master opens a deal with a volume of 1 lot, it will be copied to your account with a volume of 0.1 lot.

Please note: the investment master can trade volumes close to the minimum. When investing an amount less than the balance of such a strategy, not all transactions may be copied. Such situations can be avoided by setting an increased risk factor (the copy coefficient is multiplied by it, neutral value is always set by default as '1'). However, at the same time, the risks will also increase, so be aware when setting the coefficient!

Example: you invest 1000 USD in the strategy, the master's account balance is 10,000 USD. The copy coefficient will be calculated automatically when connected to the strategy and will be 1000/10000 = 0.1. When copying, the volume of transactions of the master will be multiplied by this coefficient. For example, if the master opens a deal with a volume of 1 lot, it will be copied to your account with a volume of 0.1 lot.

Please note: the investment master can trade volumes close to the minimum. When investing an amount less than the balance of such a strategy, not all transactions may be copied. Such situations can be avoided by setting an increased risk factor (the copy coefficient is multiplied by it, neutral value is always set by default as '1'). However, at the same time, the risks will also increase, so be aware when setting the coefficient!

Investors see all transactions in the history of the investment, but they cannot interfere in trading process (i.e. they cannot independently open new trades, modify opened trades or close any of them), but they can disconnect from the strategy at any time.

When disconnected, all open trades are automatically closed at the current prices (we remind you that closing of a trade is possible only during a trading session). Then the master's remuneration is calculated and paid, and the remaining funds are transferred to the investor's Invest Wallet.

When disconnected, all open trades are automatically closed at the current prices (we remind you that closing of a trade is possible only during a trading session). Then the master's remuneration is calculated and paid, and the remaining funds are transferred to the investor's Invest Wallet.

Unprofitable strategies will not be forcibly disconnected from the service, but you can disconnect from the unprofitable strategy at any time yourself -in the menu of the investment account, the "Subscription" tab.

Here you can also set a "Loss Limit" to limit the possible loss. When the set value is reached, your account will automatically disconnect from the investment master.

Here you can also set a "Loss Limit" to limit the possible loss. When the set value is reached, your account will automatically disconnect from the investment master.

The risk ratio can be set by investors themselves and is used to calculate the volume of copied transactions. The formula is simple:

Investor's trade volume = Master's trade volume x Copy Ratio x Risk Ratio

The minimum risk value is 0.01, while the maximum value is unlimited. You can set the risk ratio in the "Subscriptions" tab of the investment account. You can also use the risk ratio to balance the copy ratio, increase the volume of investment in a successful strategy - and vice versa.

But be careful: an increase in the ratio will cause the increase of possible risks, and its decrease may lead to the inability to copy some trades.

Investor's trade volume = Master's trade volume x Copy Ratio x Risk Ratio

The minimum risk value is 0.01, while the maximum value is unlimited. You can set the risk ratio in the "Subscriptions" tab of the investment account. You can also use the risk ratio to balance the copy ratio, increase the volume of investment in a successful strategy - and vice versa.

But be careful: an increase in the ratio will cause the increase of possible risks, and its decrease may lead to the inability to copy some trades.