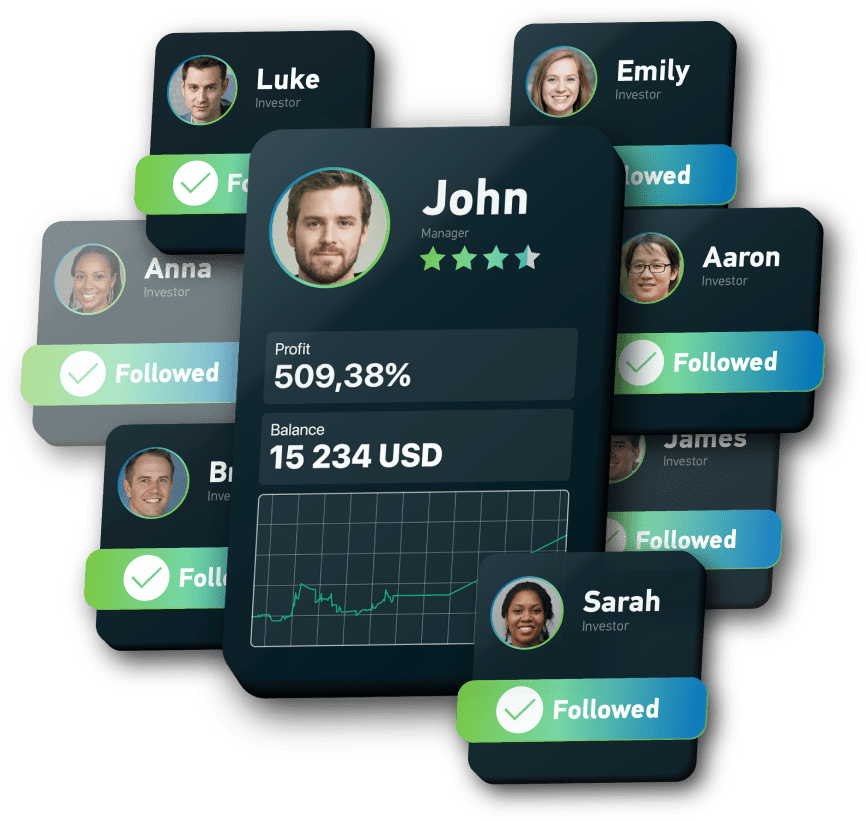

Create a Copy trading account and connect to one or more strategies from the rating.

Choose strategies based on monthly profit growth and account balance. In order to minimize the risk, set the copy ratio and drawdown limits.

Trading on a stock exchange is associated with risk, so it is natural to feel insecure about your skills.

To start placing profitable trades from the very beginning, use the experience of professionals — connect your account to their strategies. The system of Copy trading accounts will automatically follow their transactions.

Minimum investment per one trading strategy.

Single Copy trading account for hundreds of strategies.

Risk control system. The investor sets weekly drawdown limits. You can disconnect from a strategy and close trades at any time.

Orders are executed immediately at the same prices, which ensures the smallest possible commission for specific trades. It means a greater potential for profit, especially for high-frequency trading systems.

Automatic lot calculation for the opening of positions. You'll need to specify the investment amount and the weekly loss limit. All other parameters will be calculated automatically based on the ratio of your investment and the manager's funds.

Make up to 50% of the profit of your investors: you set the fee.

Trade on your own, or use EAs and high-frequency strategies.

Profit is transferred automatically at the end of each trading period.

A portfolio is a universal tool suitable both for beginners and experienced traders.

It allows distributing funds between several instruments and, as a result, to achieve higher profitability.

The key of success of a portfolio lies in the balance of assets.

|

|

Copy trading

|

Investment portfolio

|

|---|---|---|

|

Minimum budget

|

100 USD

|

1000 USD

|

|

Trading instruments

|

Any, depends on the strategy

(currencies, stocks, metals, commodities, indices, goods) |

Stocks, indices, metals

|

|

Risk diversification

|

Yes.

Possibility to invest into different strategies, set any copying ratios, set limits for profit and loss. |

Yes.

Portfolios are formed monthly based on the analysis of large amounts of data. Balanced assets allow to maximize the profit with minimum risks. |

|

Learning curve

|

Easy

|

Medium

|

|

Independent trading

|

No

|

Independent placing and closing of trades

|

|

Investing

|

In trading strategies

|

In market assets

|

|

For whom

|

Everyone

|

Everyone

|

|

Expected first profit

|

Next day after the investment

|

Portfolios are designed for periods of 1–6 months, and although the first profit may be visible on the next day, it’s recommended to wait at least 1 month to maximize your profit

|

|

Expected yield

|

Depends on the strategy

|

On the average, 15–25% per month

|

|

Ranking

|

||

|

|